March 3rd 2025, MWC Barcelona. Trustonic, the world’s largest device locking company, has today revealed the findings of a comprehensive year on year analysis of smartphone ownership across Africa.

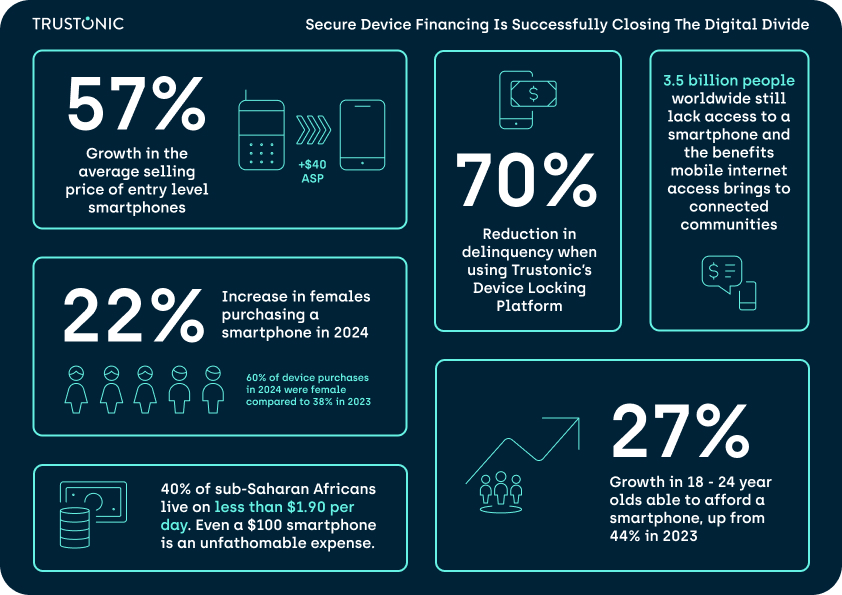

In a market where affordability remains the biggest barrier to purchase, the research shows that the Average Selling Price (ASP) of all entry level devices rose by 57%, from $70 in 2023 to $110 in 2024. With no other significant macro changes in the region, the growth is attributed to access to credit check free device financing, where consumers spread the overall cost by paying monthly.

Device financing and the Digital Divide

Access to credit, usually for the first time, is helping African consumers upgrade, in general migrating from a “talk and text” feature phone to a smartphone. Alternatively they are jumping straight to an affordable smartphone for their first device purchase, bypassing talk and text feature phones entirely. Proportionately more of these devices were taken by women in 2024, (60%), a YOY increase of 22%. This is particularly significant in a region where the gender gap in mobile internet adoption has remained at a similar level since 2017.*

Despite smartphones being widely regarded as the fastest-growing and most ubiquitous consumer purchase in history, global uptake has remained stagnant at approximately 53% of the world’s population** since 2018. While many developed economies enjoy near-saturation levels of ownership, vast segments of the global population—especially in emerging markets—continue to face significant affordability challenges.

Secure device financing has now been proven as a powerful lever to break down these barriers. Offered by operators, financiers and retailers across the region, it makes smartphones more accessible by splitting the high upfront costs into manageable payments without the need for a traditional credit rating. Device-locking technology by Trustonic is a crucial enabler of smartphone financing by reducing the risk of bad debt or repayment delinquency. The research shows that access to secure device financing has led to a paradigm shift in smartphone affordability, consistently pushing up the ASP, a 133% increase over two years, as financiers can safely offer higher tier devices to previously excluded customers.

Trustonic has removed the inherent risk for creditors with a proven ability to reduce delinquency rates and bad debt for carriers, retailers and financiers by up to 70%. For many, the financial burden for an entry-level device is significant, the World Bank cites that 40% of sub-Saharan Africans live on less than $1.90 per day and 65% live on less than $3.20 per day, so even a $100 smartphone is an unfathomable one off expense. Therefore, for many unbanked individuals, a device financing “loan” is the only viable way to afford a smartphone.

Opening the credit door is particularly enabling for the next generation of young smartphone owners. The 18-24 year old segment is the fastest growing demographic in the report with smartphone ownership increasing from 44% in 2023 to 56% in 2024, a 27% growth.

Dion Price, CEO at Trustonic commented: “A staggering 3.5 billion people worldwide still don’t have a smartphone. Closing this gap is one of the greatest challenges—and opportunities—of our time. The smartphone is the most powerful tool for economic, educational, and healthcare access the emerging world has ever seen. But affordability remains the biggest barrier by far. Our research shows that by working together with retailers and operators to provide secure, flexible financing options—all underpinned by our locking platform—we are making real progress in bridging the digital divide.”

As carriers continue to migrate customers away from 2G networks, this Premiumization trend unlocks internet access for millions in regions previously deemed unprofitable, while improving rates of digital inclusion and access to essential education, healthcare, economic opportunities and more.

Download our infographic to learn more

*Sub-Saharan Africa and South Asia continue to be the regions with the widest mobile internet gender gaps. Around 60% of women who are still not using mobile internet across LMICs live in these regions. The mobile internet gender gap in both regions narrowed over the past year, most notably in South Asia – from 41% in 2022 to 31% in 2023. While the mobile internet gender gap in Sub-Saharan Africa narrowed slightly from 36% in 2022 to 32% in 2023, it remains similar to its 2017 level (34%).

**The number of people using their own smartphone to access the internet increased to almost 4.3 billion people by the end of 2023 (53% of the global population).